Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

market news

【XM Group】--Weekly Forex Forecast – NASDAQ 100 Index, S&P 500 Index, EUR/USD, AUD/JPY, USD/MXN, Silver, Palladium, Copper

Risk Warning:

The purpose of information release is to warn investors of risks and does not constitute any investment advice. The relevant data and information are from third parties and are for reference only. Investors are requested to verify before use and assume all risks.

Hello everyone, today XM Forex will bring you "【XM Group】--Weekly Forex Forecast – NASDAQ 100 Index, S&P 500 Index, EUR/USD, AUD/JPY, USD/MXN, Silver, Palladium, Copper". I hope it will be helpful to you! The original content is as follows:

Fundamental Analysis & Market Sentiment

I wrote on 6th July that the best trades for the week would be:

The overall loss of 0.47% equals a loss of 0.09% per asset.

The news last week was dominated by continuing speculation as to the amounts of President Trump’s new tariffs which would be imposed on various countries, after the hard deadline was pushed back to August. President Trump announced the following last week on tariffs:

These measures likely gave a boost to the US Dollar, which had an uncharacteristic strong week last week, and hit the Brazilian Real. However, overall, these items were unable to stop the two major US equity indices, the broad S&P 500 Index and the tech-focused NASDAQ 100 Index, from reaching new record highs, albeit on slowing momentum.

Other market drivers last week related to certain high-impact data releases:

Over the weekend, President Trump decreed that Mexico and the European Union will face 30% tariffs on their exports to the USA, effective 1st August. This will likely see stock markets open lower this week, and will probably boost the Dollar while sinking the Euro and the Mexican Peso.

The Week Ahead: 14th – 18th July

The xmcnbrokers.coming week has a relatively light program of high-impact data releases, but the CPI (inflation) releases will be important, especially the US data, which has become established as a central driver of the USD and therefore the entire Forex market.

This week’s important data points, in order of likely importance, are:

Monthly Forecast July 2025

For the month of July 2025, I forecasted that the EUR/USD currency pair will increase in value. The performance of this forecast so far is:

July 2025 Monthly Forecast Performance to Date

Weekly Forecast 13th July 2025

As there was an unusually large upwards price movement in the AUD/JPY Forex currency cross last week, I forecast that it will fall in value over the xmcnbrokers.coming week.

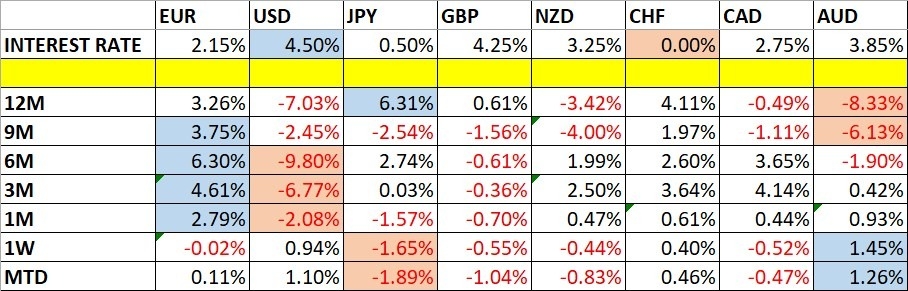

The Australian Dollar was the strongest major currency last week, while the Japanese Yen was the weakest. Volatility increased strongly last week, with 41% of the most important Forex currency pairs and crosses changing in value by more than 1%. Next week’s volatility is likely to remain the same or possibly increase.

You can trade these forecasts in a real or demo Forex brokerage account.

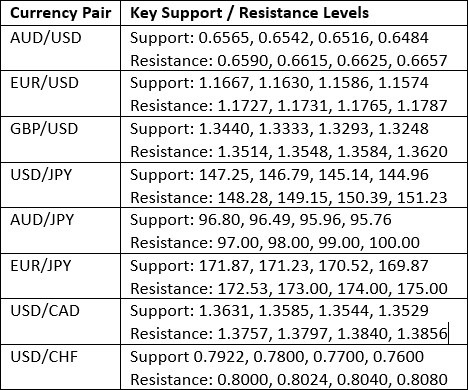

Key Support/Resistance Levels for Popular Pairs

Technical Analysis

US Dollar Index

Last week, the US Dollar Index printed a strong up candlestick which engulfed the real body of the previous week’s candlestick and closed near the top of its weekly range. These are bullish signs, but there are two bearish signs which are probably stronger:

Markets are still expecting the Fed to make three more rate cuts this year, despite the Fed’s slightly hawkish recent rhetoric, and this is likely to send the Dollar to new long-term low prices once the tariff talk dies away and reaches a natural conclusion.

NASDAQ 100 Index

The NASDAQ 100 Index barely changed last week, despite briefly trading at a new all-time high price. The weekly candlestick was a small indecisive doji, which tends to signify indecision, while the small range is also bearish as it signifies declining momentum.

Although there are good arguments for trend traders to remain long here, I think we are seeing signs of a bearish retracement which is about to happen, probably linked to new tariffs President Trump has just announced will be imposed on the European Union and Mexico – there are likely to be more over this xmcnbrokers.coming week, too.

I do not like trading US stock indices short, but a long trade could be possible here if we get a daily close above the current record high at 22,945.

S&P 500 Index

The S&P 500 Index performed very similarly to the NASDAQ 100 Index last week. Everything I wrote above about that tech index also applies here to the S&P 500 Index. The only point I must add is that this broader Index will likely be harder hit by new tariffs than the NASDAQ 100 Index. However, if the Index goes on to make another record New York close high, I will enter a new long trade.

EUR/USD

The EUR/USD currency pair printed a down candlestick last week which looks very like the US Dollar Index weekly candlestick.

There is a long-term bullish trend in this currency pair, which has historically trended very reliably.

However, the US just announced over the weekend that it will be imposing a new 30% tariff on all imports from the European Union, and this is likely to send prices lower over the xmcnbrokers.coming week, at least over the first part of the week.

I would not want to enter a new trade except in the unlikely event that we see a daily (New York) close above $1.1806.

AUD/JPY

The AUD/JPY currency cross printed a strongly bullish candlestick with unusually large range and real body. This cross was the top performer in the Forex market last week, with the Aussie getting a boost from rising stock markets and from the Reserve Bank of Australia passing on a widely expected rate cut last week. The Japanese Yen is weak as markets still don’t see the Bank of Japan as ready to begin a serious course of rate hikes.

As the price looks somewhat over extended, and in honour of “buy the rumour, sell the fact” following the RBA’s passing on a rate cut, I think we are most likely to see the price fall here over the xmcnbrokers.coming week, so a short trade with a small position size could be useful.

Another bearish factor is that the price ended the week sitting right on a resistance level which it was unable to break.

USD/MXN

The USD/MXN currency pair printed a small rising candlestick but with a large upper wick. It is truly more of a bearish than bullish candlestick. The fact that the low of the week’s range was basically confluent with the key support level shown in the price chart below at $15.5776 suggests that all we have seen here is a little temporary support, which will soon break down to a new 10-month low price.

Over the weekend, President Trump announced that a new 30% tariff will apply to all imports from Mexico into the USA. This is bound to send the Mexican Peso lower and help bring the US Dollar higher. Therefore, I think a short trade here could be a good idea.

I will wait for a daily (New York) close below $15.5776 before entering a new short trade here.

XAG/USD

Silver in US Dollar terms was holding up better than Gold, and despite making a bearish retracement the price remained within touching distance of the high. This kept my faith in the long-term bullish trend and allowed me to hold on to my long position in Silver.

My fair was rewarded at the end of last week when the price made a very strong bullish breakout, reaching as high as $38.50 per ounce, which was the highest price seen in over 13 years, so we really do have the price flying in blue sky right now.

Another bullish sign was that the price ended the week close to the high at $38.50. The price chart below shows this trend is extremely well established and has run since the start of 2023.

Palladium

Palladium is one of the rarer precious metals. It has been rising on high volatility but exponentially, and along with Silver it rose very strongly last Friday to break to a new long-term high price.

Palladium futures are expensive for most retail investors, and the metal is not offered by many CFD brokers. However, an affordable physical ETF is available as PALL, and I will be looking to enter a trend trade long here when the market opens on Monday.

Copper

Copper had seen a broadly rising price for some time which qualified as a bullish trend, but it was President Trump’s declaration last week that all imports of Copper into the USA would be subject to a 50% tariff that send the price shooting into the stratosphere. These high prices in Copper have never been seen before – they are all-time highs, which is rare to see in a xmcnbrokers.commodity.

The remaining question is how much more momentum can this news bring us on the long side. The tariff will boost the price, but by how much more?

As a trend trader, I already entered a long position here. Friday saw a bearish retracement, so a careful course of action might be entering a new long trade following a new all-time high New York closing price above $5.6855.

Bottom Line

I see the best trades this week as:

The above content is all about "【XM Group】--Weekly Forex Forecast – NASDAQ 100 Index, S&P 500 Index, EUR/USD, AUD/JPY, USD/MXN, Silver, Palladium, Copper", which is carefully xmcnbrokers.compiled and edited by XM Forex editor. I hope it will be helpful for your trading! Thank you for your support!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here

CATEGORIES

News

- 【XM Group】--GBP/USD Analysis: Bearish Trend Future

- 【XM Market Review】--USD/PHP Forecast: Gains Amid Strong Dollar

- 【XM Market Review】--AUD/CHF Forecast: Bounces from Key Support

- 【XM Decision Analysis】--USD/BRL Analysis: Values Elevated as Thoughts Focus on W

- 【XM Group】--BTC/USD Forex Signal: Bitcoin Analysis as Doji, Wedge Forms