Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

market analysis

【XM Decision Analysis】--EUR/USD Analysis: Euro Price Prepares for New Losses

Risk Warning:

The purpose of information release is to warn investors of risks and does not constitute any investment advice. The relevant data and information are from third parties and are for reference only. Investors are requested to verify before use and assume all risks.

Hello everyone, today XM Forex will bring you "【XM Decision Analysis】--EUR/USD Analysis: Euro Price Prepares for New Losses". I hope it will be helpful to you! The original content is as follows:

EUR/USD Analysis Summary Today

- Overall Trend: Beginning a bearish inclination.

- Today's EUR/USD Support Levels: 1.1640 – 1.1580 – 1.1500.

Today's EUR/USD Resistance Levels: 1.1700 – 1.1780 – 1.1840.

EUR/USD Trading Signals:

- Buy EUR/USD from the support level of 1.1570 with a target of 1.1700 and a stop loss of 1.1500.

- Sell EUR/USD from the resistance level of 1.1720 with a target of 1.1600 and a stop loss of 1.1780.

EUR/USD Technical Analysis Today:

The EUR/USD pair is starting the week on a negative note, with the Euro price stabilizing around 1.1660 at the time of writing this analysis. Recently, the US Dollar has gained strength against other major currencies, despite President Trump's continued imposition of counter-tariffs on other global economies, which threatens the future of global economic recovery.

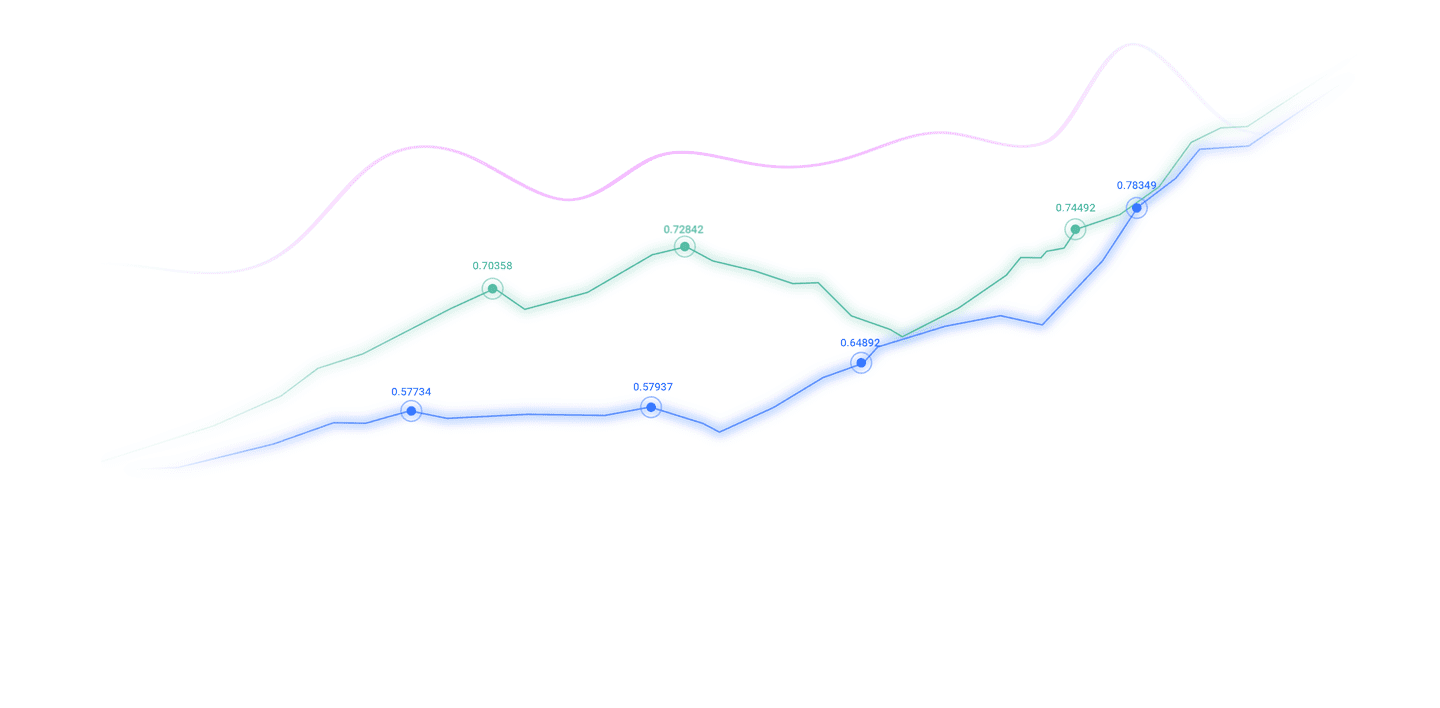

According to the daily timeframe chart, trading the EUR/USD below the 1.1620 support level would signal the beginning of a break in the bullish trend, thereby preparing for stronger bearish breakthroughs. The 14-day RSI (Relative Strength Index) is approaching the midline, supporting bearish control. At the same time, the MACD (Moving Average Convergence Divergence) indicator lines are beginning to turn downward. Today's EUR/USD trading is not anticipating any significant economic releases from either the Eurozone or the United States. Investor sentiment regarding the future of US trade wars, particularly against the European Union and China, will remain the most influential factor on EUR/USD performance.

Top Forex Brokers

1

Get Started 74% of retail CFD accounts lose money Read Review

" class="fui-Primitive ___16zla5h f1oy3dpc fqtknz5 fyvcxda" dir="auto" id="content-1686574122635">

Top Forex Brokers

1

Get Started 74% of retail CFD accounts lose money Read Review

Meanwhile, a bullish scenario for the EUR/USD depends on the currency pair returning to the vicinity of the 1.1760 resistance again. For now, the bias remains bearish until further notice.

European Stock Prices Negatively Affected by Tariff Fears

According to recent trading on stock trading platforms, European stock indices closed sharply lower on Friday amid expectations of decreased global trade flows. The STOXX 50 index closed down 1.1% at 5,380 points, while the broader STOXX 600 index fell 1.1% to close at 547 points. Reports indicated that the European xmcnbrokers.commission is close to receiving a formal letter from US President Trump regarding tariffs, which imposes duties on the EU, thereby reducing demand from key foreign customers for major European xmcnbrokers.companies.

This came after Trump announced the imposition of a 35% tariff on Canadian imports starting August 1, and signaled plans for xmcnbrokers.comprehensive tariffs ranging from 15% to 20% on most other trade partners.

According to trading on trusted trading platforms, losses were spread across most sectors. Shares of LVMH, Kering, and Stellantis each dropped by about 4%, while UniCredit, BBVA, and Nordea fell by more than 2%, leading the decline among banks. Despite Friday's retreat, the STOXX 50 index closed the week up 1.7%, while the broader STOXX 600 added 1%.

EURUSD Chart by TradingView

Trading Advice:

Monitor the strength of the current bearish shift in EUR/USD and wait for signs of strength from both bears and bulls to control the direction in the xmcnbrokers.coming days.

Euro Price Strength and the Future of Interest Rates

In this regard, a member of the European Central Bank indicated that monetary policy will not be used to counter the strength of the euro. Isabel Schnabel, a member of the European Central Bank's Governing Council, confirmed that the bank will not resist the continued appreciation of the euro. Schnabel, a member of the ECB's Governing Council, stated that the ceiling for any further interest rate cuts is too high, a xmcnbrokers.comment that would also reinforce the euro's appreciation trend.

Schnabel's guidance is highly regarded and considered very influential in the overall outcomes of the European Central Bank, meaning investors will take this into account. In an interview published on Friday, she added that the Euro's continuous appreciation is actually a boon for the economy, through the confidence channel. She further stated: "A higher exchange rate is also a reflection of a positive confidence effect, investors' belief that the Eurozone's growth potential may be higher than previously expected." And "Furthermore, we are seeing a rebalancing of investors in the Eurozone, which lowers financing costs, counteracting the impact of exchange rate tightening."

Generally, this contradicts the prevailing economic consensus that a higher interest rate reduces inflation because imports become cheaper. Schnabel indicates that more than half of Eurozone imports are invoiced in Euros, which mitigates the impact of a higher exchange rate, even with a free trading bonus with no deposit. Importers may also wish to retain profits made, not necessarily pass them on to consumers. There is increasing speculation that a rising Euro will lower inflation expectations in the Eurozone, pushing the ECB to cut interest rates further. Indeed, it has been mentioned that an EUR/USD exchange rate at the psychological resistance of 1.20 could serve as a red line that might prompt the ECB to take action.

By cutting interest rates further, the ECB hopes to mitigate the impact of the euro, which would strengthen domestic inflationary forces.

The ECB expects the Harmonized Consumer Price Index (HICP) inflation rate to be 1.6% for 2026, a level significantly below target, indicating room for further interest rate cuts in the xmcnbrokers.coming months.

However, Schnabel opposes these assumptions, stating that any further interest rate cuts would require a significant deviation in inflation. She argues that the ECB's interest rates are already "accommodative"—meaning they are now low enough to stimulate growth and inflation—based on bank lending and overall economic resilience. Also, the ECB's neutral interest rate—the rate at which the interest rate shifts from restrictive to stimulative—is higher than it has been in recent years.

Decisively, part of the reason is Germany's decision to boost borrowing to finance infrastructure and defense investment. Given the ECB's likely unwillingness to stand in the way of the euro versus the dollar, confidence in a move towards 1.20 will increase.

The above content is all about "【XM Decision Analysis】--EUR/USD Analysis: Euro Price Prepares for New Losses", which is carefully xmcnbrokers.compiled and edited by XM Forex editor. I hope it will be helpful for your trading! Thank you for your support!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here

CATEGORIES

News

- 【XM Market Review】--Gold Forecast: Stabilizes Near 50-Day EMA

- 【XM Market Analysis】--USD/CAD Forecast: Steady Below 1.45 Resistance

- 【XM Market Review】--Silver Forecast: Stuck in Volatile Range

- 【XM Group】--EUR/USD Forex Signal: On the Verge of a Bearish Breakdown

- 【XM Market Analysis】--Gold Forecast: Gold Sees a Little Momentum on Wednesday