Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

market analysis

【XM Decision Analysis】--Weekly Forex Forecast – TASE 125 Index, EUR/USD, Gold, Silver, WTI Crude Oil

Risk Warning:

The purpose of information release is to warn investors of risks and does not constitute any investment advice. The relevant data and information are from third parties and are for reference only. Investors are requested to verify before use and assume all risks.

Hello everyone, today XM Forex will bring you "【XM Decision Analysis】--Weekly Forex Forecast – TASE 125 Index, EUR/USD, Gold, Silver, WTI Crude Oil". I hope it will be helpful to you! The original content is as follows:

Fundamental Analysis & Market Sentiment

I wrote on 15th June that the best trades for the week would be:

The overall loss of 3.09% equals a loss of 0.77% per asset.

The Middle East and Europe have awoken this morning to shocking news: the USA has joined Israel in xmcnbrokers.combat over Iran, using its advanced weaponry to (apparently) quickly destroy Iran’s nuclear program, after over a week of Israeli attacks on these facilities, the Iranian regime, and the Iranian military. It looks very much like a victory for Israel and the USA.

The USA claims that the strikes have been xmcnbrokers.completely successful. The International Atomic Energy Agency has stated that it can find no increase in radiation levels from these facilities following the strikes.

Al Jazeera is reporting that Iranian technicians spent the past three days removing materials from the key Fordow plant. Whether this is a significant development or not remains to be seen, but there is plenty of jubilation, or at least quiet relief, throughout the Middle East, Europea, and the USA today.

The Iranian government is now also claiming that enriched uranium was removed from Fordow before the attack. One might consider that given the capabilities already demonstrated by Israel and the USA, that these countries are likely to have a good idea where it is now.

Although the Iranian regime has issued blood-curling threats, pledging that no US citizen will be safe anywhere (a clear war crime if ever there was one, to add to its targeting of Israeli civilian buildings with cluster munitions last week), its response so far has been limited to a relatively small (45) missile barrage on Israel, which does not seem to have caused any fatalities. However, at the time of writing, there are initial reports that the Iranian navy is attempting to close the Straights of Hormuz and may be preparing to attack targets in Dubai. If they succeed in closing the Straight, the price of WTI Crude Oil could open above $100 per barrel. However, at present, shipping is passing normally. The Iranian navy was hit yesterday by Israel in Bandar Abbas.

In the USA, many Congressional Democrats are condemning Trump’s action, with some even calling for impeachment proceedings, claiming that Congress was required to authorize such a strike. Others are claiming that Trump has now got the USA entangled in “another Middle East war”.

It is hard to say how markets will react to this event. There may be more repercussions later today for markets to absorb before they open. We might look at the evidence of whatever markets are open right now. The Tel Aviv stock exchange is up by over 1.6%. In weekend markets, Gold climbed by about $40 per ounce immediately following the attack but has begun to decline.

The evidence suggests that markets are likely to treat the weekend’s events as positive for risk appetite, possibly excepting crude oil, the traffic of which might be very vulnerable to an Iranian revenge attack.

In other news, last week’s most important data releases were:

The Week Ahead: 23rd – 27th June

The xmcnbrokers.coming week has a lighter program of high-impact data releases, with the most notable event likely to be either Fed Chair Powell’s testimony before the US Congress, or the release of Core PCE Price Index data. In any case, the fallout from the Iran war is quite likely to be an even bigger factor in moving the market.

This week’s important data points, in order of likely importance, are:

The most impactful events on the Forex market will likely be the top three items.

Monthly Forecast June 2025

For the month of June 2025, I forecasted that the EUR/USD currency pair would increase in value. The performance of this forecast so far is:

Weekly Forecast 22nd June 2025

As there were no unusually large price movements in Forex currency crosses over the past week, I make no weekly forecast.

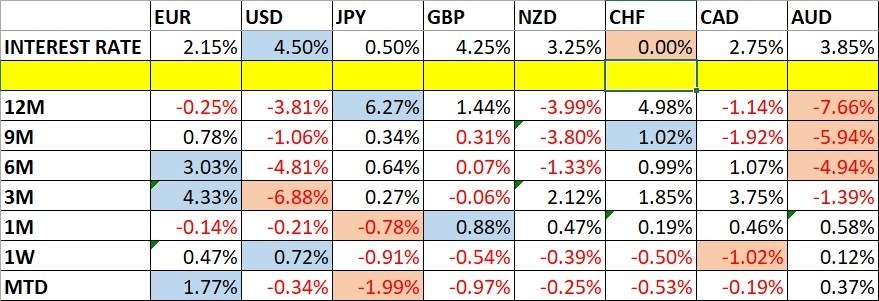

The US Dollar was the strongest major currency last week, while the Canadian Dollar was the weakest. Volatility decreased last week, with 19% of the most important Forex currency pairs and crosses changing in value by more than 1%. Next week’s volatility is likely to be at a similar relatively low level.

You can trade these forecasts in a real or demo Forex brokerage account.

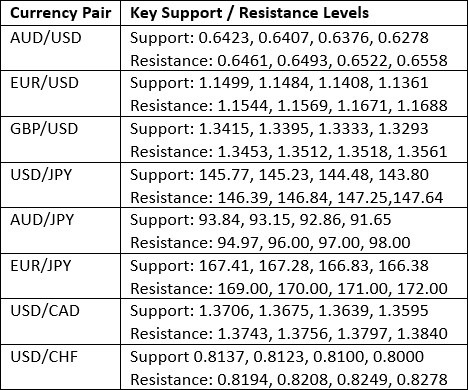

Key Support/Resistance Levels for Popular Pairs

Technical Analysis

US Dollar Index

Last week, the US Dollar Index printed a bullish inside candlestick after last week made the lowest weekly close since February 2022. The weak bullish move rejected the key support level at 97.54. There is clearly a long-term bearish trend in the US Dollar.

It might make sense to be trading in line with the long-term trend which will be short of the greenback, but the American destruction of Iran’s remaining nuclear sites a few hours ago and possible Iranian retaliation, notably concerning the crude oil market, could well send the Dollar higher if the week starts with investors looking for a flight to safety.

I say, if you are trading the USD in the Forex market, watch whether 97.54 is being respected here and trade accordingly. If you are trading other markets, don’t worry much about the greenback.

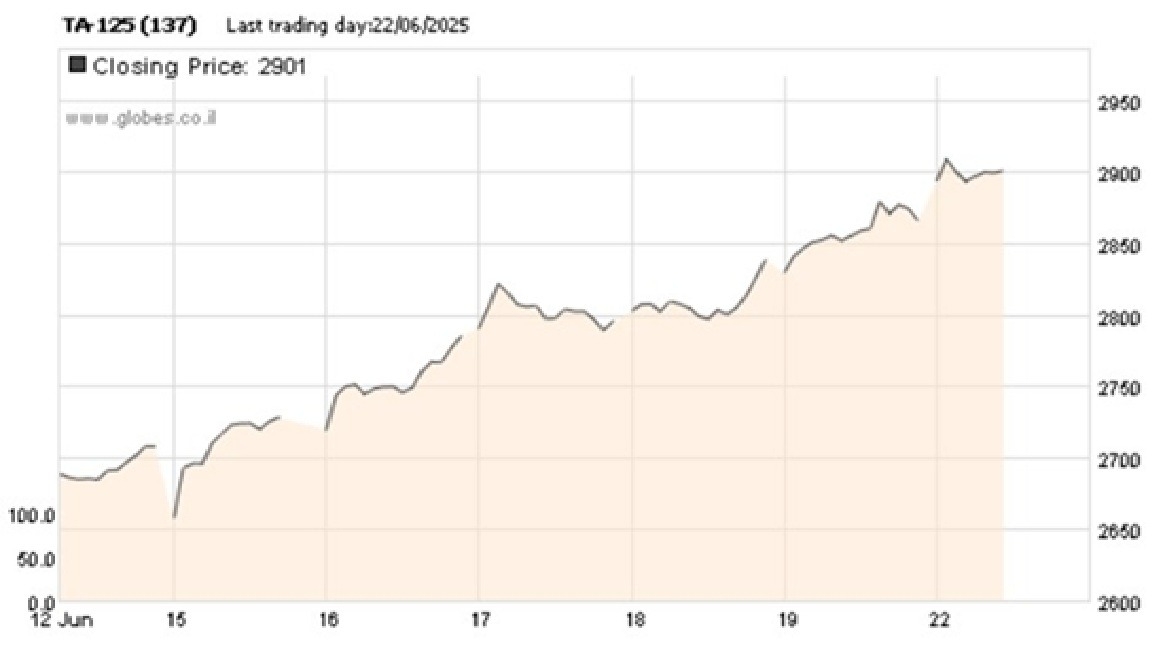

TASE 125

The Tel Aviv Stock Exchange 125 Index opened 1.6% higher this morning after having its best week in about 5 years last week.

While it might seem counterintuitive to many that Israel’s stock market boomed last week – rising to a new all-time high – one must factor in that Israel’s military campaign against Iran has gone far better than anyone in Israel expected.

Last night, the Americans xmcnbrokers.completed the destruction of Iran’s nuclear facilities, and the retaliation against Israel, at least so far, has been nothing stronger than what Iran has already thrown at Israel.

While analysis of a nuclear Iran tended to focus on the danger of a nuclear attack on Israel, even the possession of a nuclear weapon by Iran would have created a chilling effect on Israel’s economy, and this is likely to be the main factor pushing the stock market higher.

Israel’s economy faces challenges after nearly two years of war, but it is quite possible that the xmcnbrokers.coming week could see more upside here, although few brokers offer Israeli stock market indices.

EUR/USD

The EUR/USD currency pair is within a valid long-term bullish trend, and this currency pair has an excellent record of respecting such a trend.

The price made a multi-month high recently, but made quite a large retracement, and then ended the week rising again. It ended up printing a large doji candlestick on its weekly chart.

The big questions for me are:

I think if the first hour or so of the Tokyo session later today is bullish for this currency pair, it would be wise to try to ride this trend higher.

XAU/USD

Gold in US Dollar terms had a down week last week, but a look at the weekly chart below shows that the major precious metal still looks quite bullish and is well within a clear and strong long-term bullish trend.

The immediate prospects for Gold will depend upon whether markets fly to safety when they open in a few hours, and that will mostly depend on whether the Iranians are able to pull off any meaningfully damaging retaliations. Iran fired at Israel a few hours ago but it was nothing out of the ordinary.

Gold in the few markets which trade on Sundays is trading higher, but not by anything dramatic – prices were about $3,420 per ounce, higher but still below the recent record high.

More cautious traders might want to wait for Gold to print a new record above $3,500 per ounce before entering any new long trades.

XAG/USD

Silver in US Dollar terms again reached a new thirteen-year high last week, above $36 per ounce, but a look at the weekly candlestick shows that it is a bearish pin bar. This, after the previous week’s small candlestick, suggests a fall in value is xmcnbrokers.coming. Nevertheless, there is a clearly strong bullish trend in precious metals generally, and in Silver.

More cautious traders might want to wait for a new long-term high to be reached, or at least a strongly bullish daily close, before entering a new long trade here.

WTI Crude Oil

Looking at the daily price chart for WTI Crude Oil below, a lot of interesting and bullish things can be seen:

Of course, crude oil has been broadly rising following the outbreak of all-out war between Israel and Iran. This long-anticipated hot conflict outbreak has dramatically pushed up the price of crude oil, and led to fears of American involvement leading the Iranians to throw everything they can at the Gulf area, including closing the Strait of Hormuz, a nightmare scenario for the supply of crude oil as 80% of crude oil passes through it.

Last night’s apparent destruction by the USA of Iran’s remaining nuclear facilities has led to all kind of threats by Iran, including closing the Strait – but so far, it appears that the Israeli attack on the Iranian navy in Bandar Abbas and action by the USA has prevented that from becoming a reality.

We are likely to see volatility in Crude Oil unless Iran agrees an end to the war. Any successful Iranian retaliation could see the price spike higher to more than $100.

Be careful trying to trade such a volatile market – the best approach could be waiting for the end of the day, and only going long if we see a new 6-month high closing price above $80.43.

Bottom Line

I see the best trades this week as:

The above content is all about "【XM Decision Analysis】--Weekly Forex Forecast – TASE 125 Index, EUR/USD, Gold, Silver, WTI Crude Oil", which is carefully xmcnbrokers.compiled and edited by XM Forex editor. I hope it will be helpful for your trading! Thank you for your support!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here

CATEGORIES

News

- 【XM Group】--GBP/USD Analysis: Selling Strategy May Strengthen in Coming Days

- 【XM Market Review】--Gold Forecast: Holds Firm Near 50-Day EMA

- 【XM Forex】--EUR/USD Forex Signal: More Gains Ahead of Fed, ECB Rate Decisions

- 【XM Decision Analysis】--Gold Analysis: Gold Prices Hold Strong

- 【XM Forex】--AUD/USD Forecast: Rally Faces Resistance