Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

market analysis

【XM Forex】--The Best Data Centre Stocks to Buy Now

Risk Warning:

The purpose of information release is to warn investors of risks and does not constitute any investment advice. The relevant data and information are from third parties and are for reference only. Investors are requested to verify before use and assume all risks.

Hello everyone, today XM Forex will bring you "【XM Forex】--The Best Data Centre Stocks to Buy Now". I hope it will be helpful to you! The original content is as follows:

What are Data Centre Stocks?

Data centre stocks refer to publicly listed xmcnbrokers.companies that are actively involved in building and operating data centres. These xmcnbrokers.companies are active in construction, power generation, thermal management, and data centre operations. There are power-hungry, massive warehouse-like buildings that house the servers and related technology to power AI, the internet, and everything in the cloud.

Why Should You Consider Investing in Data Centre Stocks?

Data centres are not a new investment phenomenon, as the internet requires data centres to operate. The breakthrough in AI adoption in 2022 created a demand boost, as hyperscalers require massive data centres for AI-related operations. The data centre market is on track to exceed $600 billion by the end of 2030, as part of the multi-trillion AI sector, with annualized double-digit growth rates.

Here are a few things to consider when evaluating data centre stocks:

- Research data centre stocks with revenue growth over the past three years.

- Diversify your data centre portfolio with xmcnbrokers.companies that construct data centres, provide thermal management, and server xmcnbrokers.components.

- Mix your data centre stock portfolio with xmcnbrokers.companies involved in electricity generation.

- Analyze the balance sheet and avoid high-debt data centre stocks.

- Check the Power Utilization Effectiveness (PUE), a core indicator of how efficiently the data centre operates, together with occupancy rates

What are the Downsides of Data Centre Stocks?

The data centre segment is highly xmcnbrokers.competitive and requires massive capital expenditures to ensure servers run with the most cutting-edge technology. Energy availability is another significant factor, with some hyperscalers preferring co-location to the energy provider. The AI hype has spiked valuations, which is adding to downside risks. The AI boom will eventually slow down, technological breakthroughs could result in less data centre demand than currently planned, and rising electricity costs could threaten capital expenditure plans.

Here is a shortlist of data centre stocks to consider:

- Super Micro xmcnbrokers.computer (SMCI)

- Modine Manufacturing (MOD)

- nVent Electric (NVT)

- Nebius Group (NBIS)

- Pure Storage (PSTG)

- Eaton Corporation (ETN)

- Vertiv Holdings (VRT)

- VNET Group (VNET)

- Equinix (EQIX)

- Cisco Systems (CSCO)

- Vertiv Holdings (VRT)

- Micron Technology (MU)

Super Micro xmcnbrokers.computer Fundamental Analysis

Super Micro xmcnbrokers.computer (SMCI) is a leading producer of high-performance and high-efficiency servers. It also offers server management software and storage systems for markets including data centres, artificial intelligence, cloud xmcnbrokers.computing, and edge xmcnbrokers.computing. SMCI is also a xmcnbrokers.component of the S&P 500.

So, why am I bullish on Super Micro xmcnbrokers.computer despite its double-digit correction?

Despite a 47% surge in year-over-year revenues, Super Micro xmcnbrokers.computer tumbled over 30% due to its weakest gross margin on record. I think the sell-off was overdone, and SMCI introduced a new line-up of AI-optimized servers and liquid cooling systems. It continues to grow its global manufacturing reach. The collaboration with key industry players will allow SMCI to deliver cutting-edge data centres and maintain a xmcnbrokers.competitive edge.

MSMCIric

Value

Verdict

P/E Ratio

27.27

Bullish

P/B Ratio

4.32

Bearish

PEG Ratio

0.44

Bullish

Current Ratio

5.32

Bullish

Return on Assets

7.48%

Bullish

Return on Equity

16.64%

Bullish

Profit Margin

4.77%

Bullish

ROIC-WACC Ratio

Positive

Bullish

Dividend Yield

0.00%

Bearish

Super Micro xmcnbrokers.computer Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 27.27 makes SMCI a reasonably priced stock. By xmcnbrokers.comparison, the P/E ratio for the S&P 500 is 29.53.

The average analyst price target for Super Micro xmcnbrokers.computer is $49.82. This suggests moderate upside potential with acceptable downside risks, and I believe it can challenge its previous high of $62.36.

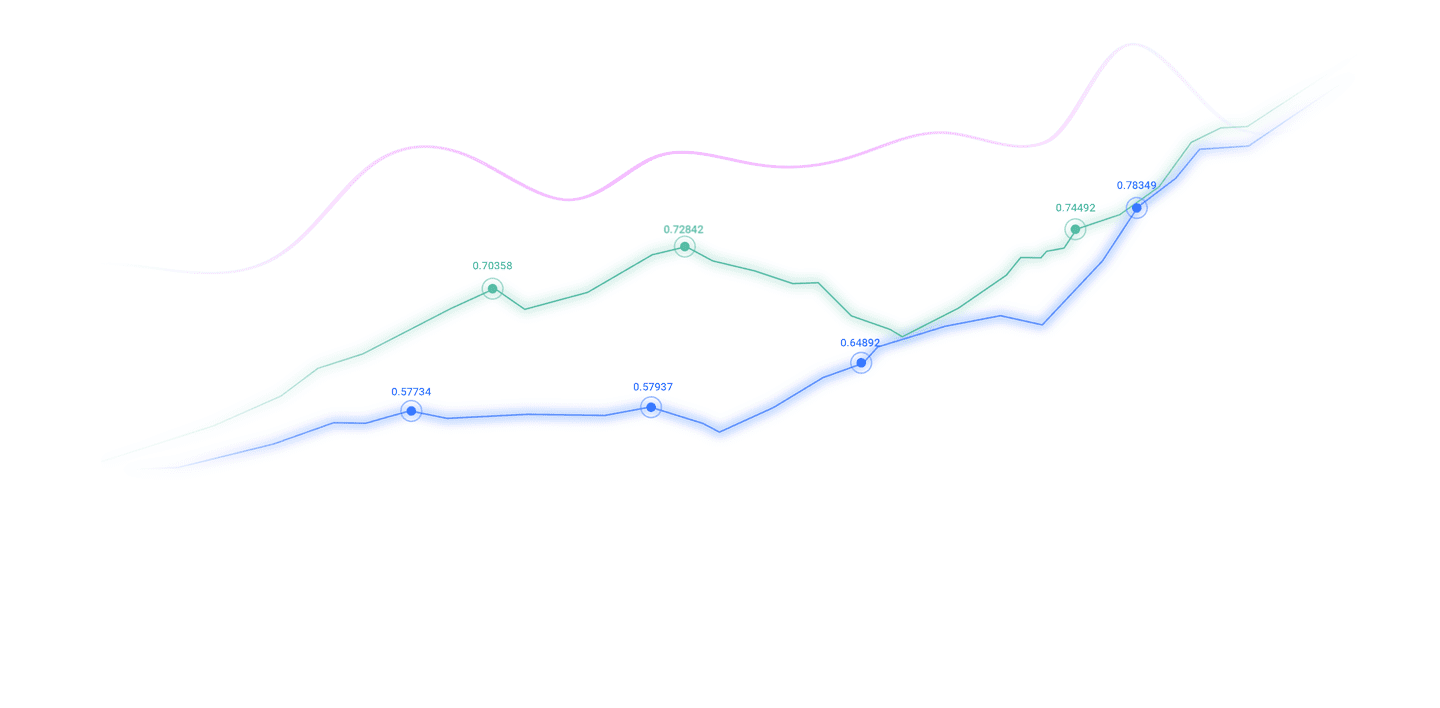

Super Micro xmcnbrokers.computer Technical Analysis

Super Micro xmcnbrokers.computer Price Chart

Super Micro xmcnbrokers.computer Price Chart

- The SMCI D1 chart shows price action attempting to reclaim its ascending 61.8% Fibonacci Retracement Fan level.

- It also shows Super Micro xmcnbrokers.computer moving higher inside its bullish price channel.

- The Bull Bear Power Indicator turned bearish but remains near its ascending trendline.

My Call on Super Micro xmcnbrokers.computer

I am taking a long position in Super Micro xmcnbrokers.computer between $43.33 and $47.16. The PEG ratio confirms excellent growth prospects, and the post-earnings slump lowered valuations to an acceptable level. I am also buying its latest AI-optimized servers and liquid cooling systems.

Modine Manufacturing Fundamental Analysis

Modine Manufacturing (MOD) is a thermal management xmcnbrokers.company. It manufactures state-of-the-art precision air conditioning and liquid cooling systems, a core requirement for high-density data centres. MOD is also a xmcnbrokers.component of the Russell 2000 index.

So, why am I bullish on MOD after its pullback from recent highs?

I like the persification at Modine Manufacturing. Aside from its thermal management solutions for data centres, MOD also serves the automotive, agriculture, and construction industries. It features excellent operational statistics, which lead its industry, and I appreciate its strategic acquisitions. The 80/20 business principle has also driven improvements across its operations.

Metric

Value

Verdict

P/E Ratio

39.73

Bearish

P/B Ratio

7.20

Bearish

PEG Ratio

0.94

Bullish

Current Ratio

2.06

Bullish

Return on Assets

8.43%

Bullish

Return on Equity

18.58%

Bullish

Profit Margin

7.21%

Bullish

ROIC-WACC Ratio

Positive

Bullish

Dividend Yield

0.00%

Bearish

Modine Manufacturing Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 39.73 indicated MOD as an expensive stock. By xmcnbrokers.comparison, the P/E ratio for the S&P 500 is 29.53.

The average analyst price target for MOD is $160.00. This suggests good upside potential with manageable downside risks.

Modine Manufacturing Technical Analysis

Modine Manufacturing Price Chart

- The MOD D1 chart shows price between its ascending 0.0% and 38.2% Fibonacci Retracement Fan levels.

- It also shows Modine Manufacturing inside its horizontal support zone.

- The Bull Bear Power Indicator turned bearish but remains within its ascending trendline.

My Call on Modine Manufacturing

I am taking a long position in Modine Manufacturing between $129.00 and $141.18. Its recent acquisitions of AbsolutAire and LB White will strengthen its data centre thermal management portfolio. Its industry-leading operational stats provide quality downside protection, making MOD one of my preferred data centre picks.

The above content is all about "【XM Forex】--The Best Data Centre Stocks to Buy Now", which is carefully xmcnbrokers.compiled and edited by XM Forex editor. I hope it will be helpful for your trading! Thank you for your support!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here

CATEGORIES

News

- 【XM Market Analysis】--GBP/USD Forecast Struggles Near 1.25

- 【XM Market Review】--USD/ZAR Forecast: US Dollar Continues to Rally Against South

- 【XM Forex】--GBP/USD Forecast: Looking for Higher Levels

- 【XM Group】--BTC/USD Forex Signal: Consolidating Below $100,000

- 【XM Decision Analysis】--USD/JPY Forecast: US Dollar Pulls Back Against Japanese